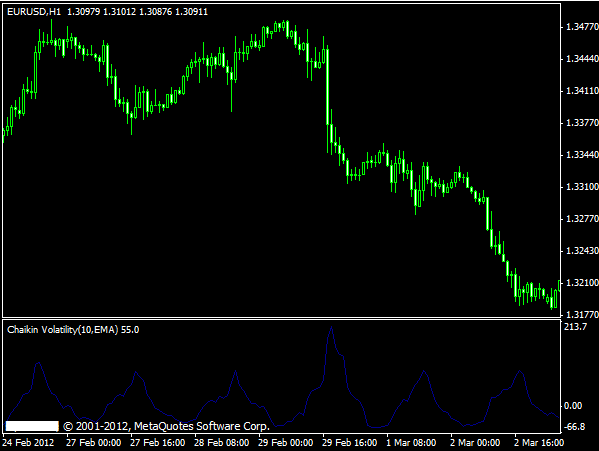

Chaikin Volatility Best Forex volatility indicator - spread indicator mt4

Overview:

Chaikin's Volatility indicator compares the spread between a safety's high and costs which are low. It quantifies volatility as a widening for the range involving the high and also the cost that is low.

Interpretation:

You can find two ways to interpret this measure of volatility. One technique assumes that market tops are usually associated with increased volatility (as investors get indecisive and stressed) and that the second stages of market bottom are generally speaking associated with decreased volatility (as investors get annoyed).

Another method (Mr. Chaikin's) assumes that an upsurge in the Volatility indicator over a somewhat brief time frame shows that a base is near (age.g., a panic sell-off) and that a decrease in volatility over an extended time period indicates an approaching top (e.g., a mature bull market).

As with nearly all investors that are experienced Mr. Chaikin advises that you don't count on any one indicator. He suggests utilizing a average that is going or trading musical organization system to verify this (or any) indicator.

Post a Comment