Trending Price Action Forex Strategy

Trending Price Action Forex Strategy

“Trade with the trend!”

Trading against the trend is very difficult. It is like swimming on a river going upstream. Trading against the trend means you are trading against the momentum of the market. This stacks all the odds against you. Imagine, you are trading against the whole market. It is like you against the trading world.

So, many traders decide to try trading with the trend. But, many new traders who decided to be a trend following trader don’t even know how to properly identify a trend. How could we trade with the trend if we don’t know how to identify the trend?

There are many ways to identify a trend. One could use a moving average, or a band of moving averages. Others use indicators. Others intuitively look at a naked chart.

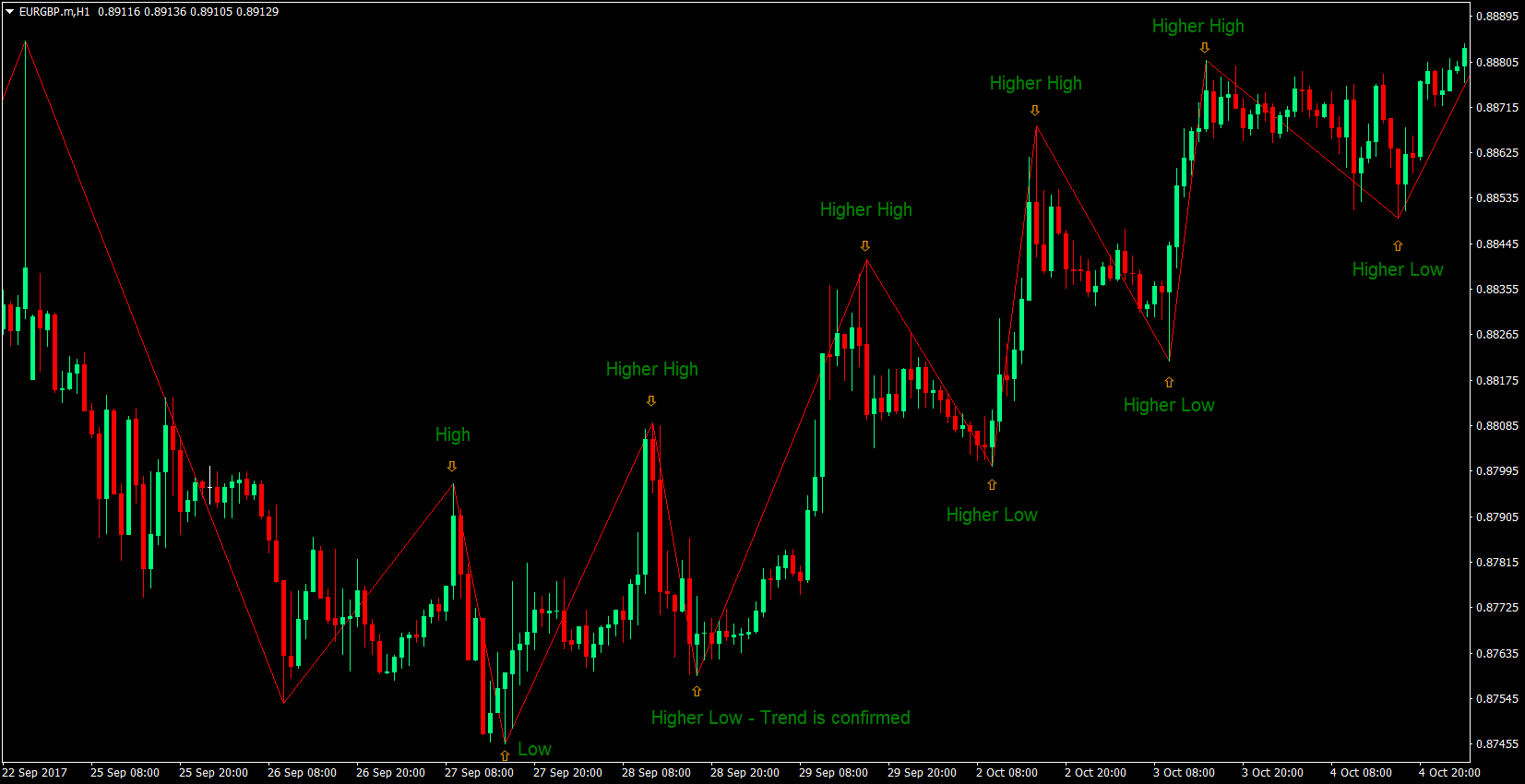

Price action traders typically look at a naked chart to identify a trend. They define an uptrend as one that prints a higher high compared to the previous high, and confirmed by a higher low compared to the previous low. For a downtrend, they define it as one that prints a lower low compared to the previous low and confirmed by a lower high compared to the previous high.

The ZigZag Indicator

Newbies in price action trading though, find it hard to assess a swing high and low. On a naked chart, without any indication pointing a swing high or swing low, this may seem confusing and cause lack of confidence on a trading setup. What we could do however, is use the ZigZag indicator to help us identify the swing highs and swing lows. This makes things much easier.

Marking Support Areas

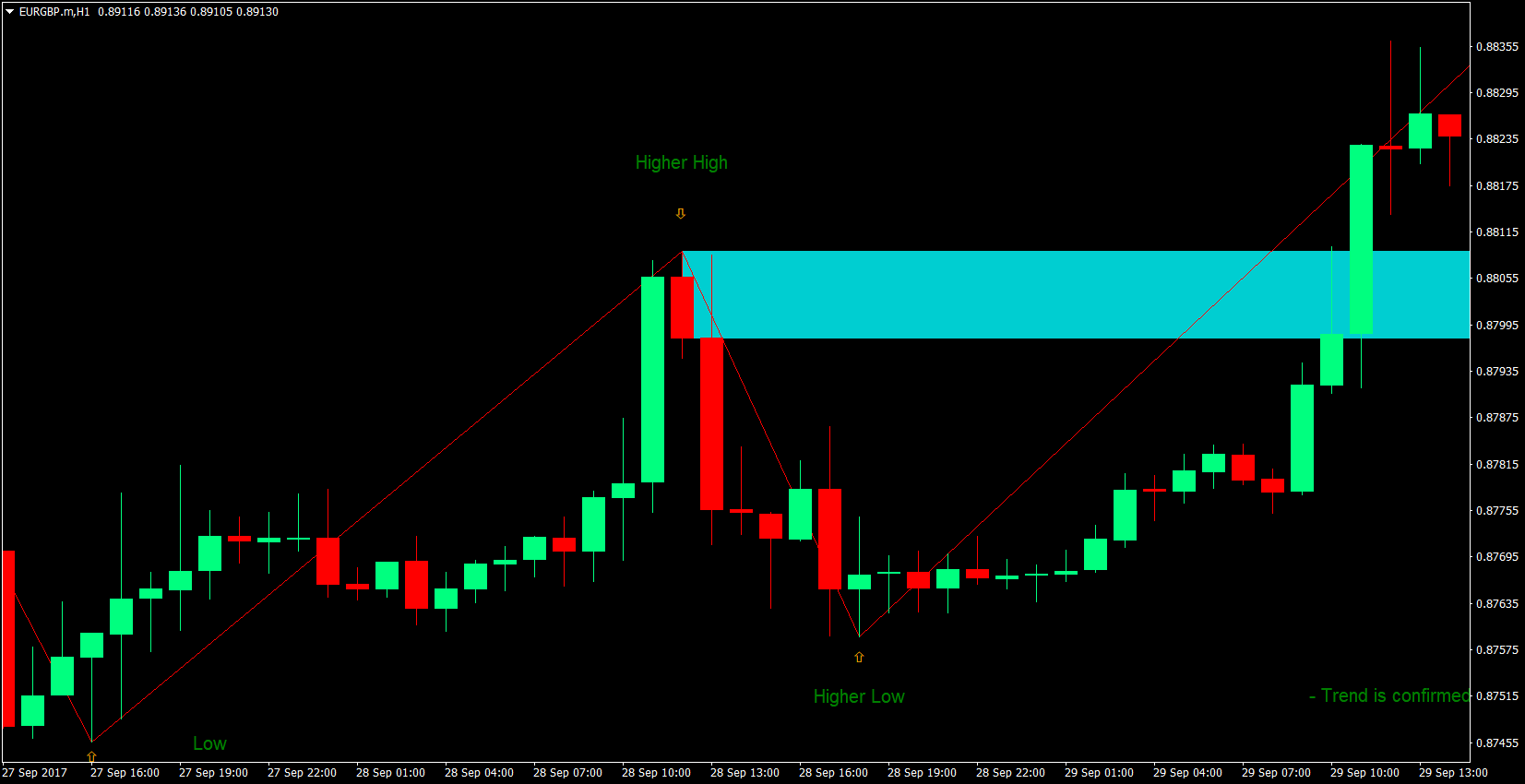

One concept in trading is that an area of resistance, once broken, becomes an area of support. In a trending market, possible horizontal areas of resistance are constantly broken. This creates for us, areas of support, which we could trade on.

To trade this system, we will be marking the broken highs as areas of support. To mark these areas of support, on an uptrend, we will be marking from the upper wick of a swing high up to its whole body.

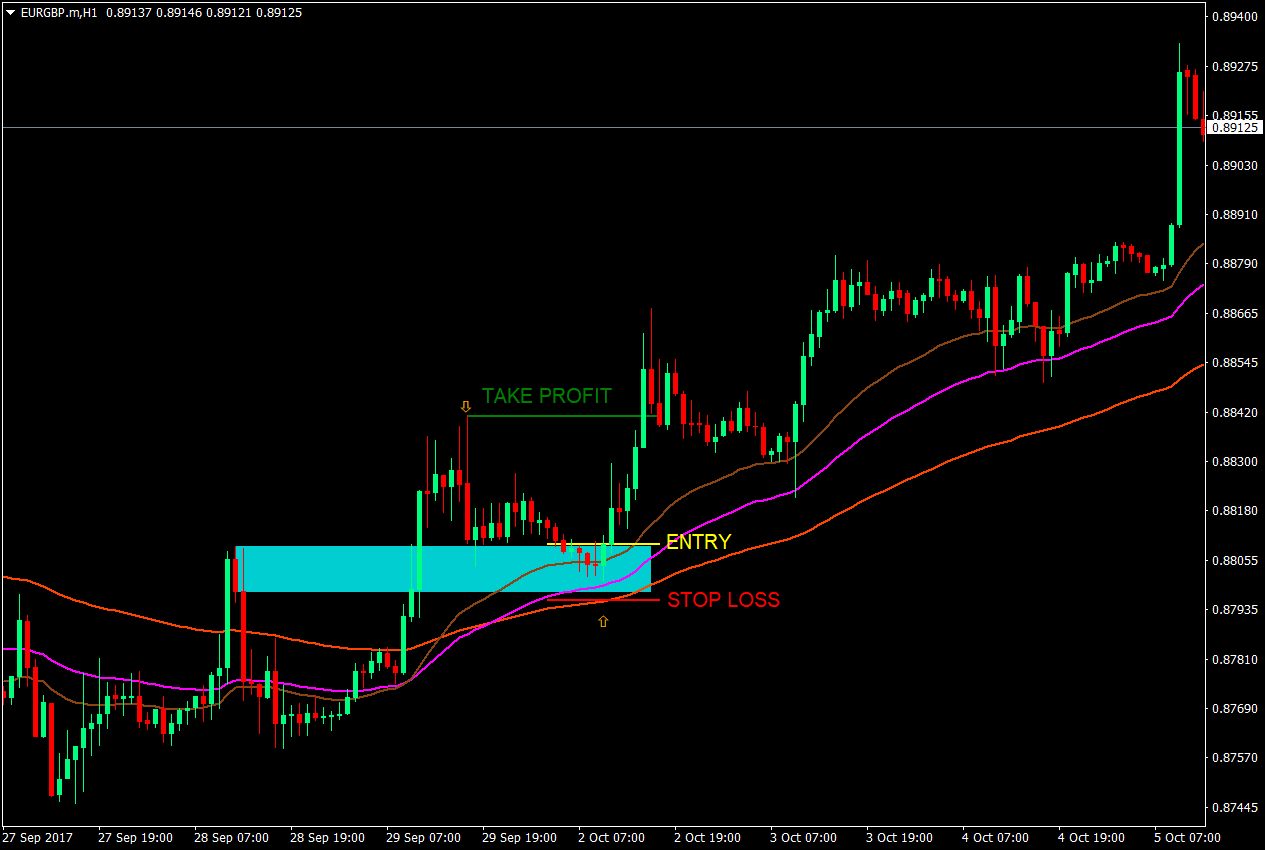

On the chart below, notice how price respects these areas of support during this bullish market.

Trade Setup: Entry, Stop Loss & Take Profit

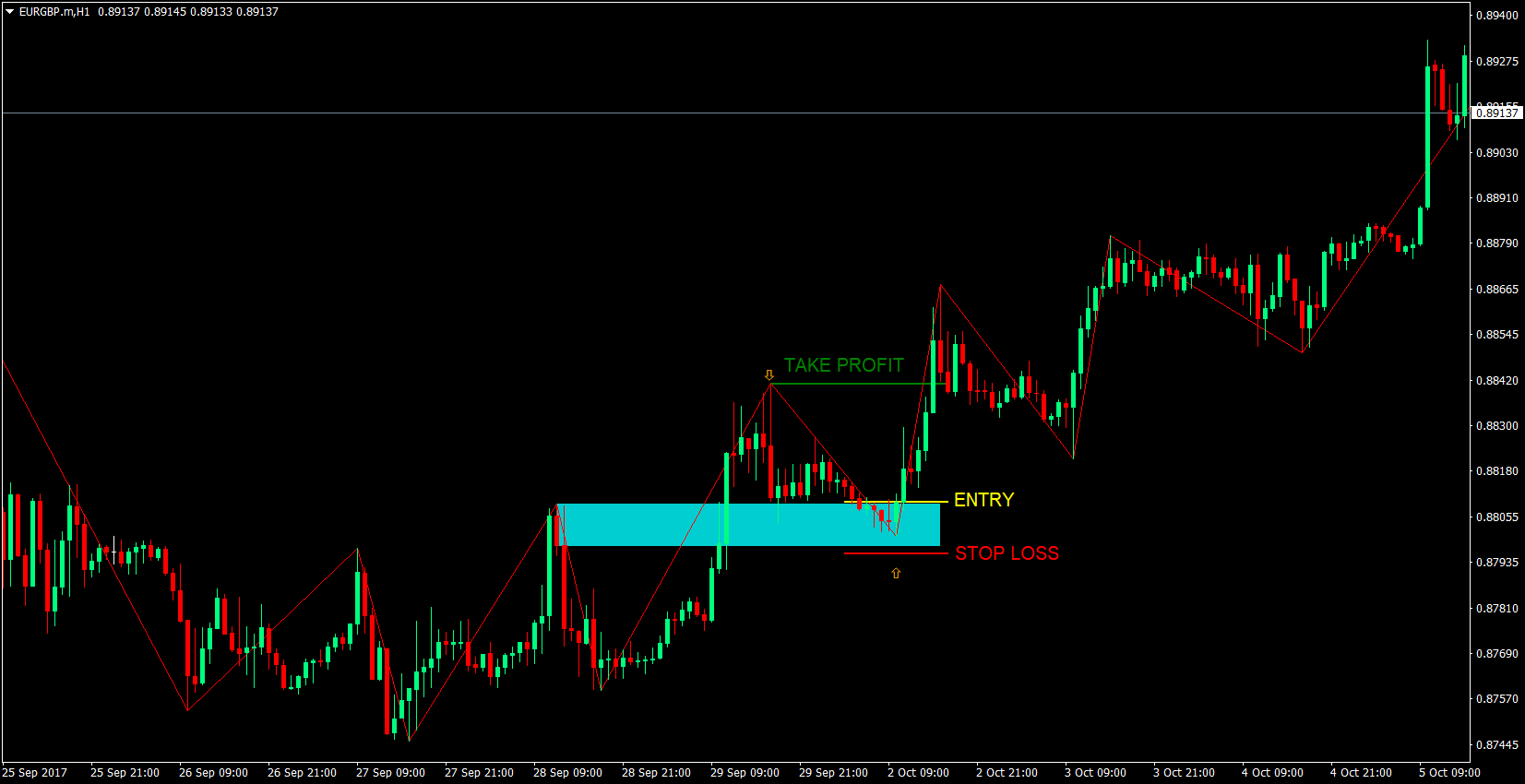

Since the chart analyzed is a bullish market, we will be analyzing a buy setup.

Entry: We will be waiting for price to retrace back to the area of support. Once price reaches the area, we will be looking for it to bounce off the area. As soon as price creates a reversal candlestick pattern that closes above the support area, we enter the trade.

Stop Loss: The stop loss should be a few pips below the support area.

Take Profit: The target take profit should be placed at the peak of the swing high.

Conclusion

This strategy is a simple market flow type of trading strategy, which utilizes the power of a trending price action. Given that both market flow and trending price action is combined into a trading strategy, the trade setups become more of a high probability trade setup. This increases the chances that the take profit would be hit instead of the stop loss.

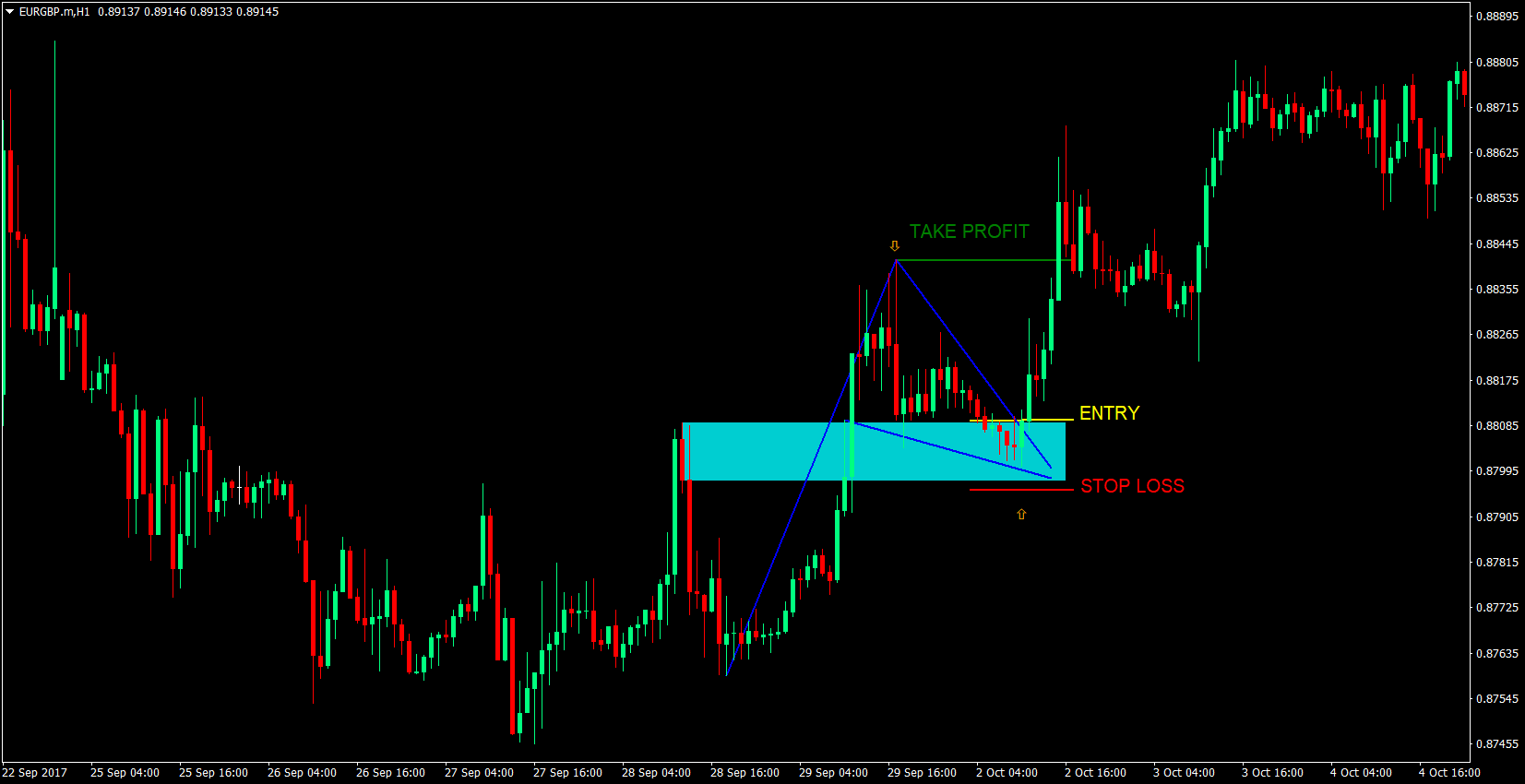

Another trading strategy that could be combined with this is the bull flag strategy. If you would look closely, the retracements could also be considered as a bull flag that broke through a diagonal resistance.

Also, if you would be using a three-band moving average as a compliment to this strategy, you would also find that the three-band moving average is also stacked neatly on top of the other, indicating a trend, and that the start of the thrust also took off from a dynamic support formed by the moving averages.

Other traders who trade diagonal channels could also see it on a different light. They could say that the trade was a bounce off the diagonal support.

There are many ways to skin the cat. You could trade this setup using different strategies. All these trading systems in confluence just increases the odds that the setup would be in profit.

The advantage of using the price action or market flow type trading strategy is that it allows traders to easily define the areas where they could look for the reversals or bounces. Unlike bull flags and diagonal supports and resistances, due to the horizontal characteristic of its supports and resistances, it becomes easier for traders to assess if the reversal took place in the correct area.

This strategy is a high probability strategy on its own. Professional traders also use horizontal supports and resistances. But combined with other strategies, it becomes more powerful.

Forex Trading Systems Installation Instructions

Trending Price Action Forex Strategy is a combination of Metatrader 4 (MT4) indicator(s) and template.

The essence of this forex system is to transform the accumulated history data and trading signals.

Trending Price Action Forex Strategy provides an opportunity to detect various peculiarities and patterns in price dynamics which are invisible to the naked eye.

Based on this information, traders can assume further price movement and adjust this system accordingly.

Post a Comment