ERXGen BreakOut MultiCurrency Trader Forex EA – [Cost $2499] – For FREE

ERXGen BreakOut MultiCurrency Trader Fx Expert Advisor – [Cost $2499] – For FREE

Without volatility, trading the financial market is near impossible. Profit is made ONLY when the price is moving.

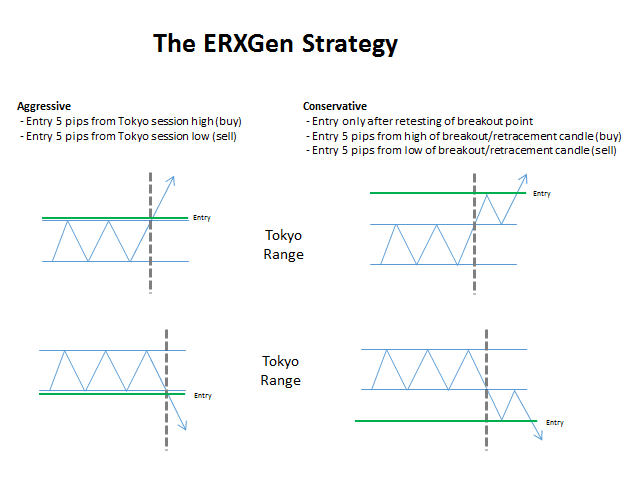

The ERXGen (Early Riser Next Generation) Breakout System is a short-term trading technique built around the phenomenon that there are certain times of the trading day when price volatility has the tendency to be high.

Following the release of extremely popular indicator – ERXGen Filter, being employed by many traders this is an automatic trading system giving traders even more benefits for his or her trading.

Price action during the Tokyo trading session is used to work out trade entry levels. Buy and/or Sell trades are taken mostly during the London trading session.

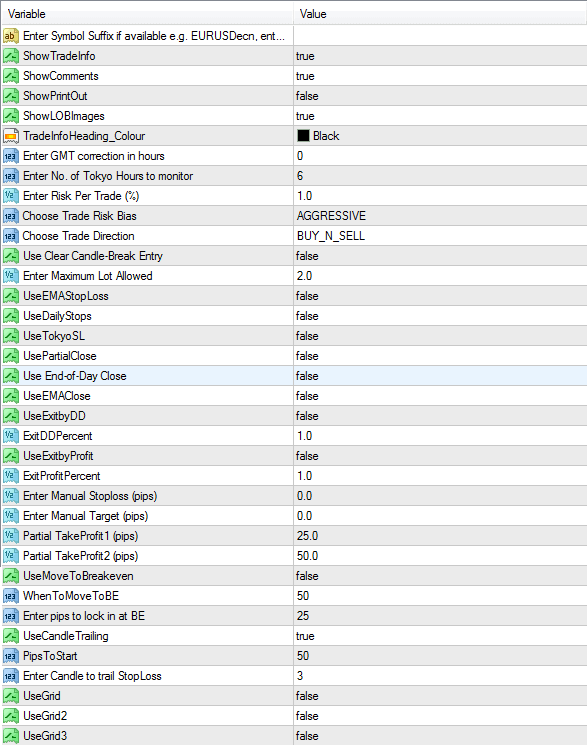

Parameters

- Show Trade Info – if TRUE, this is a visual display on the top right corner of the chart with key trade information e.g. lot sizes, account balance, equity, drawdown, number of trades, profit, risk percent, etc.

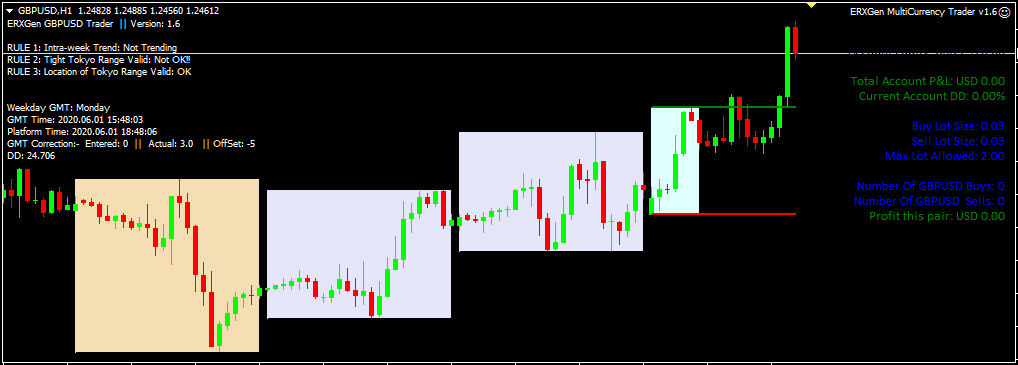

- ShowComment – if TRUE, this displays comments on the chart showing the status of the three rules, GMT time, breakout candles, etc

- Show PrintOut – if TRUE, this prints out and logs information on the ‘Experts’ tab of the platform. It can be a drain on memory. Recommended as ONLY a trouble-shooting tool.

- Show LOBImages – if TRUE, there is a visual display of three previous days and the current day’s price action. The current day’s price action shows two sets of lines – Greenline depicting Tokyo session highest price and Redline depicting Tokyo session lowest price

- TradeInfoHeading_Colour – the color of the trade information title

- Enter GMT Correction in hours – the difference in hours between MT4 platform time and GMT

- Enter No. of Tokyo Hours to Monitor – number of hours during the Tokyo session to be used to monitor price action

- Risk Per Trade % – the user has the option to select percent risk for each trade to be taken. Most traders will between either 1, 2, or 3%. It’s up to the trader’s risk profile. Smaller accounts may require higher values to give a lot size of 0.01 micro lot.

- Trade Risk Bias – the user can choose either ‘AGGRESSIVE’ or ‘CONSERVATIVE’ settings. Aggressive setting instructs the EA to place buy stops & sell stops a few pips above the green line or a few pips below the red line. Conservative settings will only place buy/sell stops after a breakout and following price retracement either to the green or red line. See video for details

- Trade Direction – the user can choose if to trade buys & sells, only buys, only sell, or no trades

- UseClearBreakoutEntry – if TRUE, this is a slight modification to aggressive entry where buy or sell stops are placed only if the breakout candle closes above the green line or breakout candle closes below red line. See video for details

- MaxLot allowed – the user can enter the maximum lot size the EA can enter trades with.

- UseDailyStops – if this is TRUE, the next setting (UseTokyoSL) should be FALSE. Daily stops are instructing the EA to place stop loss for buy trades on the low of the previous day and for sell trades on the high of the previous day

- UseTokyoSL – if this is TRUE, the previous setting (UseDailyStops) should be FALSE. The EA places buy stop-loss few pips below the red line (Tokyo session lowest price) and sell stop loss few pips above the green line (Tokyo session highest price)

- UsePartialClose – the user has an option to partially close profitable trades

- UseEoDClose – if TRUE, the EA closes any open trade at the end of the day (at 23:55)

The three key rules are:

- Intra-week trend

- Tight Tokyo Range (gap between high and low price during Tokyo session must be low, ranging and not trending)

- Location of the Tokyo Range (price action during Tokyo session must happen either at the top or bottom of the previous day’s range)

This Multi-Currency Automated Trader comes with huge benefits

- Multi-Currency Pairs for EUR and GBP

- Well-written algorithms, precise and fast

- More like a trade assistant than a robot

- Allows for user intervention

- Manages risk – lot sizes, trade sizes

- Manages trades – trade size, trade targets, trade stop loss, stop loss management (move to breakeven, trailing, partial closes, etc)

- Additional control parameter e.g. stop loss based on EMA, trade recovery techniques, etc

- Visual display

Post a Comment